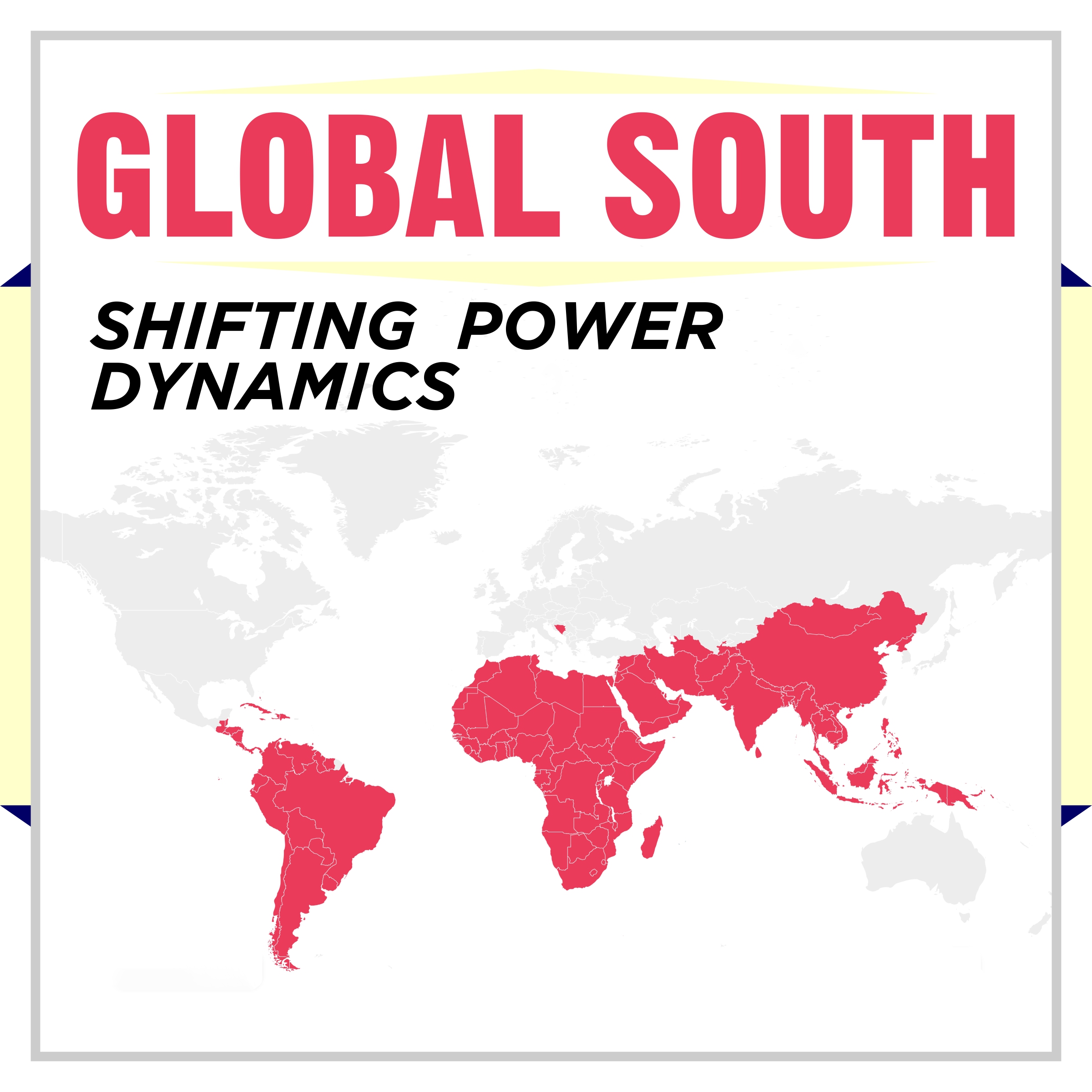

The US dollar's dominance in international transactions is facing a formidable challenge. Countries worldwide, particularly emerging economies, are seeking alternatives to reduce their dependence on the greenback. This phenomenon, known as de-dollarisation, has gained significant momentum globally, with Russia and China leading the charge.

De-dollarisation: The Rise of a Multipolar Currency World

At the heart of de-dollarisation lies a desire to challenge the dollar's hegemony and promote local currencies, cryptocurrencies, and alternative payment systems. This phenomenon has gained significant traction, with the European Union and China actively promoting the euro and yuan as alternatives to the US dollar for global transactions and reserves. The BRICS nations – Brazil, Russia, India, China, and South Africa – are also collaborating to reduce US dollar dominance and promote local currencies. This collective effort is driven by a desire to create a more multipolar currency world, where emerging economies have greater control over their financial systems.

The implications of de-dollarisation are far-reaching and multifaceted. As countries move away from the dollar, the US government's ability to finance its growing fiscal deficit will be compromised. This could lead to a decline in the dollar's value, making imports more expensive and potentially leading to higher inflation. On the other hand, de-dollarisation could lead to a more stable and diversified global financial system, where no single currency dominates international transactions.

Russia and China are at the forefront of de-dollarisation efforts. Both countries have been actively promoting their local currencies and commodities to settle international trades. China has made significant strides in internationalising its currency, the renminbi (RMB), and has established swap agreements with several countries, including Russia and Saudi Arabia. Russia, on the other hand, has been developing its own payment system, the System for Transfer of Financial Messages (SPFS), as an alternative to the SWIFT network.

The rise of cryptocurrencies and alternative payment systems is also contributing to de-dollarisation. Cryptocurrencies, such as Bitcoin and Ethereum, offer a decentralised and secure way to conduct transactions, reducing the need for intermediaries like banks. Alternative payment systems, such as China's UnionPay and India's Unified Payments Interface (UPI), are also gaining traction, providing users with more options for conducting transactions. These innovations have the potential to democratise access to financial services and create new opportunities for economic growth and development.

Despite the momentum behind de-dollarisation, there are several challenges that need to be addressed. One of the main concerns is the lack of interoperability between different payment systems. As countries develop their own payment systems, there is a risk that these systems may not be compatible with one another, leading to fragmentation and inefficiencies. Moreover, the development of alternative payment systems requires significant investment in infrastructure and technology.

The US dollar's dominance is facing a significant challenge, and the newly elected Trump administration is caught in a dilemma. Can Trump turn the tide on de-dollarisation and restore the US dollar's fading dominance, or will the momentum towards a multipolar currency world prove unstoppable?

Trump has threatened to impose 100% tariffs on BRICS nations if they introduce or support a currency that could challenge the US dollar. This move is seen as an attempt to maintain the dollar's dominance, but it may have unintended consequences. Imposing tariffs could lead to a trade war, causing economic instability and potentially accelerating the decline of the dollar's value. Moreover, the BRICS nations are not alone in their pursuit of de-dollarisation. The European Union is also exploring options to reduce its reliance on the dollar.

It remains to be seen how Trump's administration will respond to these challenges. Will they continue to impose tariffs and try to maintain the dollar's dominance, or will they adapt to the changing global financial landscape and explore new options for promoting American economic interests? One thing is certain – the world is moving towards a more multipolar currency system, and the US dollar's dominance is unlikely to remain unchallenged.

In conclusion, de-dollarisation is a complex and multifaceted phenomenon that has the potential to reshape the global financial landscape. As countries move away from the dollar and promote their local currencies, the world is likely to become more multipolar. While there are challenges that need to be addressed, the benefits of de-dollarisation, including greater financial independence and reduced reliance on the US dollar, make it an attractive option for many countries. As the world becomes increasingly interconnected, it is likely that de-dollarisation will continue to gain momentum, leading to a more diverse and resilient global financial system.